Some Of Home Warranty Cost

Wiki Article

Home Warranty Coverage - An Overview

Table of ContentsHome Warranty Cost for DummiesThe Ultimate Guide To Home Warranty InsuranceRumored Buzz on Home Buyers WarrantyThe Best Guide To Home WarrantySome Of Appliance InsuranceSome Of Home Warranty CoverageLittle Known Questions About Home Appliance Insurance.

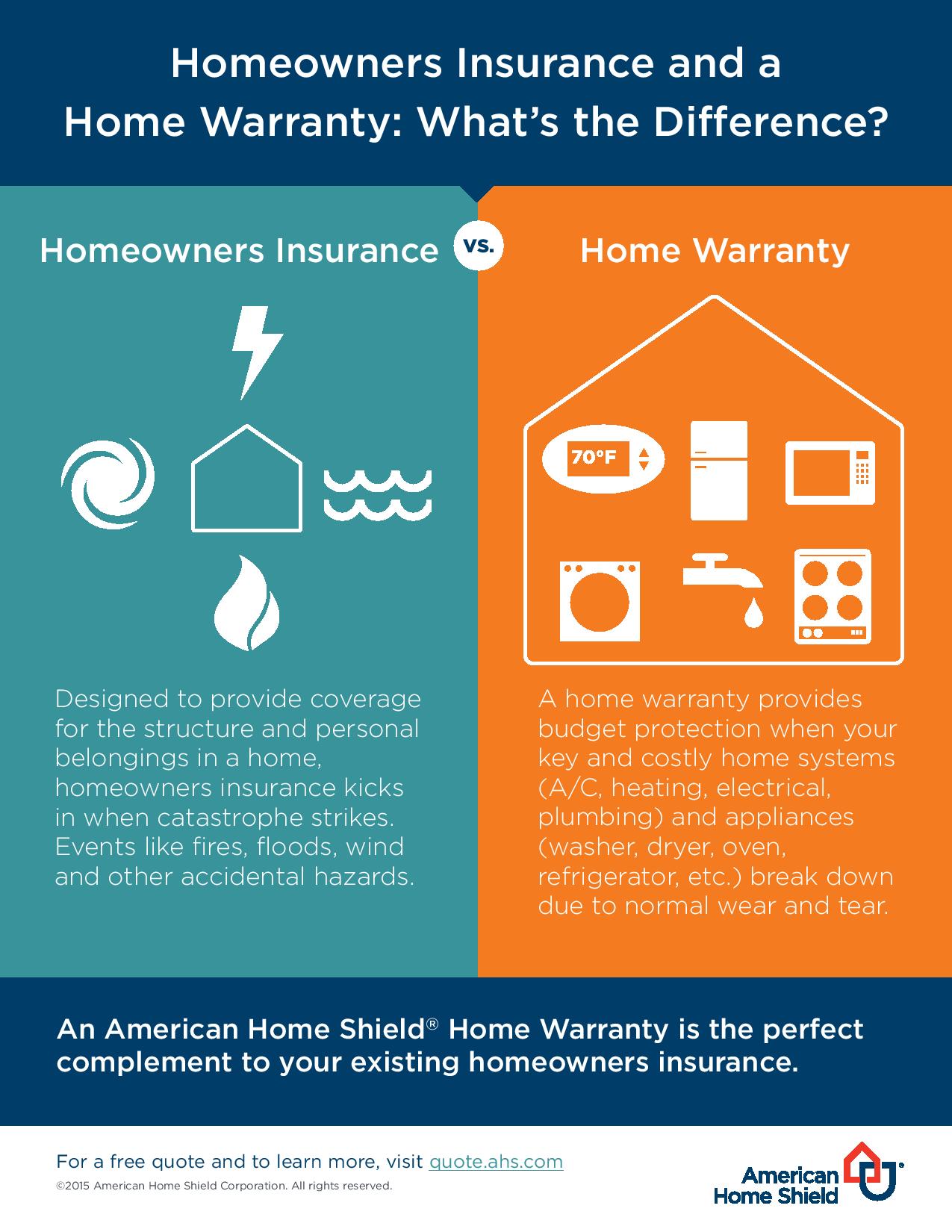

A home guarantee is a solution contract that covers the expense of household system as well as device substitute or repair services if they damage down because of age or typical damage. Property owners insurance policy does not cover wear and tear, which is why people sometimes buy a home warranty (along with a homeowners policy) to supplement that space in protection. home warranty companies.If you add several improvements as well as upgrades onto your plan, you might be checking out a yearly expense as high as $1,000 not that much less than the average annual cost of homeowners insurance. The cost of the strategy itself, you'll have to pay a service fee every time a technician or agreement is sent to your residence for evaluations or repair work.

Is residence service warranty insurance coverage worth it? With a home service warranty, you have the comfort of knowing your house systems and devices are shielded if they quit working, and the comfort of not having to look for a specialist or specialist each time. Guarantees are not constantly a good offer, specifically if you have a more recent house with systems as well as devices still covered under supplier or contractor service warranties.

7 Easy Facts About Home Warranty Cost Explained

Some bank card business and also online sellers will certainly also double the maker's service warranty, further lessening the need for guarantee insurance coverage. The pros of house guarantees, If you're a new house owner: Service warranties are specifically beneficial if you're a new homeowner who may not understand that to call if your air-conditioning quits working eventually.If you live in an older residence: A service warranty may also be a bargain if you stay in a residence with older systems and also devices. If you're acquiring an older residence, the purchaser's assessment will likely include details about the age and also problem of the house's home appliances. If the evaluation discovers, state, plumbing as well as electrical concerns, it could be a lot more beneficial to see if the seller would certainly want to cover the costs of brand-new systems and devices as opposed to obtain a warranty.

The terrific feature of tools break down insurance coverage is that unlike with residence warranties there are few cautions. All systems as well as appliances are covered versus everything from inappropriate setup to electrical failing. The only reason for break down that isn't covered is age as well as regular damage, which is something that is covered under a house warranty.

Appliance Insurance Fundamentals Explained

Your guarantee business will certainly then bill you a deductible, which is the charge that you need to pay of pocket before the warrantor will cover the rest of the prices. Service warranty deductibles are typically in between $60 as well as $120 for the solution. House service warranty business, Now that you have actually taken into consideration the advantages and disadvantages of house guarantees, below are a few of the top residence guarantee firms.These use different insurance coverage degrees, so make sure to study any warranty contract details prior to buying. Also if you decide to restore the warranty agreement from year-to-year, double-check your plan's information as there is a possibility of the coverage altering yearly. Kinds of Home Service Warranty Protection As home guarantee strategies differ, you need to check what is covered under your strategy.

Indicators on Home Warranty Companies You Need To Know

A standard house service warranty coverage includes major systems and daily use home appliances. The products covered in a residence service warranty difference between homeowners insurance and home warranty plan can also vary from state to state.Optional coverage consists of those things that are not covered under the standard or improved plans. These are not the typical home appliances that a lot of households have. This coverage gives you the option of adding your swimming pool, health club, a glass of wine cooler, well pump, etc, to your home service warranty plan. You need to pay a repaired additional costs to put optional add-ons in your house warranty plan.

WHAT DOES A RESIDENCE SERVICE WARRANTY COVER? Some companies structure their home warranty prepares right into systems-only, appliances-only, and also combination plans, while others adhere to the fundamental, boosted, and also tailored design that we simply described.

Examine This Report on Home Warranty Cost

The sample brochure from the company would certainly specify the items that are covered under the home guarantee. What Items Are Not Covered In Standard And Also Enhanced House Warranty Plans?A mindful analysis of the solution contract can stop several misunderstandings as well as frustrations. When it comes to home appliances, the adhering to components are generally omitted: Baskets Detachable Components Dials Door Glass Drawers Filters Flues Outside or below ground piping Halogen System Takes care of Inside Lining Knobs Light Sockets Light Changes Lights Lock And Also Key Assemblies Magnetic Induction Cooktop Pans Portable Or Freestanding home appliance insurance companies Microwave Racks Refrigerator/Oven Mix Unit Rollers Runner Guards Sensi-heat Burners Shelves Timers And Also Clocks that do not impact the performance of the home appliance Garbage Compactor Buckets Trays Trim Kits Vents An additional important detail regarding a house guarantee plan that numerous stop working to recognize is that the protection amount is limited (home appliance insurance).

The solution call charge or a insurance deductible of a residence service warranty varies from $50-$125. Each time you sue, you have to pay a deductible. Consumers need to likewise note that the solution telephone call cost differs from firm to firm. The costs rates is reliant on numerous various other aspects that you can discover in our overview on house guarantee expenses.

Home Warranty Companies Things To Know Before You Buy

There is a short waiting period to ensure that the systems and also house appliances are not malfunctioning also because of pre-existing conditions. Most service warranty carriers have a thirty days waiting period, while a couple of have a 10-day waiting duration. Some firms supply the option to reduce home warranty plans cost the waiting duration if a house inspection report can be offered.For How Long Does House Warranty Insurance Coverage Last? House service warranty policies typically last for 12-13 months and also can be renewed at the end of the term. House service warranty companies restore the contracts instantly as the year or contract duration ends. Take down the expiry day of your agreement as some companies do not provide automatic revival, as well as you 'd have to renew your agreement to proceed using their services manually.

Some firms provide a possibility to cancel within the very first 30 days of the contract duration, while some expand the duration to 60 days. The Base Line A residence service warranty provides a cushion for unidentified concerns that property owners may encounter throughout the year. This will certainly make them feel reassured that any type of repair work or replacement would certainly be covered with a residence warranty.

Report this wiki page